Australia is gearing up for a significant shift in corporate reporting with the introduction of mandatory sustainability disclosures. Starting in 2025, new standards will be in place, aiming to enhance transparency and accountability regarding corporate sustainability. If you are a NetSuite user, CarbonSuite is your go-to SuiteApp for preparing your business’ AASB reports. Here’s our breakdown of the Australian Sustainability Reporting Standards (ASRS).

The Framework

The Australian Accounting Standards Board (AASB) has drafted three Australian Sustainability Reporting Standards (ASRS) to guide these disclosures:

- AASB 1: General requirements for climate-related financial disclosure.

- AASB 2: Detailed climate-related financial disclosures.

These standards align with the global IFRS S1 and IFRS S2, focusing on climate-related risks.

Key Requirements

Climate Resilience Assessments

Scenario Analysis

Organizations must evaluate their resilience under at least two climate scenarios, including a low-emission pathway consistent with limiting warming to 1.5°C and a ‘high’ emission (2.5C or higher) scenario.

For example:

A manufacturing company may analyze the impact of a 1.5°C scenario involving stricter global carbon regulations (e.g., carbon pricing) and a 3°C scenario predicting more frequent extreme weather events like floods. This would involve modeling impacts on production, supply chains, and costs.

Adaptation and Mitigation

Entities need to outline how they will adapt to identified risks and mitigate them, including planned adoption of technologies, reliance on offsets, or process changes.

For example:

A renewable energy company might describe plans to invest in more efficient solar panel technologies and highlight its strategy to offset emissions through certified carbon credits. They could also present a timeline for achieving net-zero goals

Governance and Risk Management

Climate-related risks must be embedded into the organization’s governance and risk management processes, with clear accountability.

For example:

A mining company might establish a climate risk committee reporting to the board, tasked with monitoring physical risks like droughts affecting water availability. They would also measure transitional risks such as shifting investor preferences toward low-carbon portfolios.

Disclosure of Methodologies and Assumptions

Organizations must disclose key inputs, assumptions, uncertainties, and the rationale for chosen scenarios.

For example:

A financial institution assessing portfolio vulnerability to climate risks might specify assumptions regarding carbon intensity trends in key sectors (e.g., energy or transport), uncertainties about policy changes, and the financial models used.

Metrics and Targets

Disclosures must include specific metrics, such as physical risks, transitional risks, and GHG emissions. This would include any sustainability or emission reduction targets as well.

Physical risks: Proportion of assets vulnerable to extreme weather events.

Transitional risks: Value of investments in industries at risk from decarbonization policies.

Greenhouse Gas (GHG) Emissions: Scope 1 and 2 emissions in initial reports, expanding to Scope 3 in subsequent periods.

For Example:

A utility company may report that 20% of its assets are in regions prone to flooding under a high-risk scenario and detail the associated remediation costs. They could also disclose GHG emissions reductions through investments in wind and solar energy.

Greenhouse Gas Emissions

Reporting must follow methodologies outlined in Australia’s National Greenhouse and Energy Reporting (NGER) Act.

Scope of Emissions Reporting

Entities must disclose Scope 1, 2, and 3 emissions defined under the GHG Protocol. They must also provide the conversion to CO2 Equivalent (CO₂e). To do so, they can use global warming potential factors aligned with the Intergovernmental Panel on Climate Change (IPCC) and local legislation like the National Greenhouse and Energy Reporting (NGER) Scheme.

Entities are also required to disclose absolute emissions and intensity metrics (e.g., emissions per unit of revenue or production).

Measurement Methodologies

Entities must prioritize using methodologies from Australia’s NGER Scheme. Foreign measurement frameworks can only be used if local methodologies are unavailable or impractical.

Disclosure of Data Sources

Entities must explain the sources of data used for measuring GHG emissions, including any limitations or uncertainties.

For example:

A company could state that Scope 3 emissions data is based on supplier-provided estimates, with uncertainties due to data collection gaps.

Phased Implementation

Reporting obligations will start for the largest entities in Jan 2025, expanding to smaller groups in 2026 and 2027.

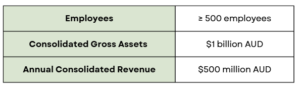

Large Entities (Group 1)

Entities that meet two out of three criteria:

First Reporting Period: Financial years starting on or after January 1, 2025.

Additional Criteria: Includes reporters under the NGER Act with emissions exceeding 50,000 tonnes of CO₂ equivalent (Scope 1 and 2).

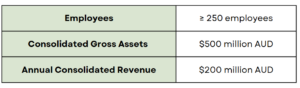

Medium-sized Entities (Group 2)

Entities meeting two of these thresholds:

First Reporting Period: Starting July 1, 2026.

Additional Criteria: Includes organizations not covered by Group 1 but registered under the NGER Act.

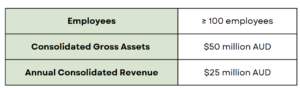

Smaller Entities (Group 3)

Entities with two of the following

First Reporting Period: Beginning July 1, 2027.

Asset Owners

Registrable superannuation entities, registered investment schemes, or retail Corporate Collective Investment Vehicles (CCIVs) with $5 billion or more in assets under management.

First Reporting Period: Start aligns with respective group timelines based on size thresholds.

Exemptions

Small businesses below the minimum size thresholds.

Charities and Not-for-profits exempt under Chapter 2M of the Corporations Act.

Assurance and Compliance

To ensure credibility, sustainability reports will undergo phased audits, starting with limited assurance on Scope 1 and 2 emissions and escalating to full audits by 2030.

How Can CarbonSuite Help?

CarbonSuite is the only Built for NetSuite solution for mandatory sustainability reporting in Australia. As certified experts in both NetSuite and sustainability reporting, CarbonSuite helps you streamline and integrate your sustainability process within your existing financial and operational processes in your NetSuite ERP system.

CarbonSuite uses Built for NetSuite features like our Emission Workbench and our AI Data Scanner to automate the sustainability reporting process. Our SuiteApp ensures that you stay compliant and up to date with sustainability reporting mandates.

Make ASRS reporting a breeze by using NetSuite to get prepared today. Contact us to get started.

Not in Australia but wondering if your business is subject to any disclosure mandates? Check out our Sustainability Disclosure Tracker.