CSRD Reporting deadlines are coming fast. Beginning Jan 1st, 2025, many companies will be mandated to submit reports to the CSRD. If unprepared, data collection and reporting can be tricky, which is why CarbonSuite was designed to easily automate CSRD Reporting within NetSuite.

In CarbonSuite’s Guide to CSRD Reporting, we will go through the following points so that you leave feeling well-prepared for upcoming reports.

Who is Subject and When?

What Information is Required?

CSRD NetSuite Best Practices

Who is Subject to CSRD Reporting?

The Corporate Sustainability Reporting Directive (CSRD) is a piece of EU Legislation, replacing the Non-financial Reporting Directive (NFRD), designed to enhance the scope and quality of sustainability reporting by corporations. It mandates disclosure of sustainability-related information, requiring that sustainability information is reported with the same rigor as financial data, setting the stage for audit requirements.

As it is a piece of EU Legislation, the CSRD is designed for companies operating with the EU. But who exactly needs to submit these reports and when depends on a variety of factors.

Reporting is rolled out in a phased approach: It began in 2024 and is rolled out through 2029. Let’s take a look at who needs to report and when.

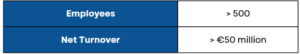

NFRD Companies

Reporting Begins: Jan 1, 2024

Report Due: Jan 1, 2025

(Meaning companies must report on data from 1st of January 2024)

NFRD Companies are companies that are already subject to NFRD Reporting. This means they are publicly listed and meet one of the following:

OR

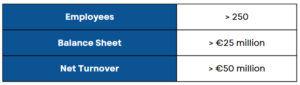

Large EU Companies

Reporting Begins: Jan 1, 2025

Report Due: Jan 1, 2026

(Meaning companies must report on data from 1st of January 2025)

Companies who meet two of the following:

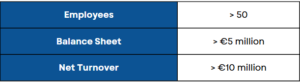

Listed Small and Medium Enterprises (SMEs)

Reporting Begins: Jan 1, 2026

Report Due: Jan 1, 2027

(Meaning companies must report on data from 1st of January 2026)

Listed SMEs are unique in the aspect that they are able to delay reporting under certain conditions. If they are able to prove that they cannot provide adequate information by the reporting date, these businesses are able to opt out until a later date.*

SMEs are defined as companies who meet two of the following:

*If opting out, reporting begins Jan 1, 2028, with reports due Jan 1, 2029.

Non-EU Companies

Reporting Begins: Jan 1, 2028

Report Due: Jan 1, 2029

(Meaning companies must report on data from 1st of January 2028)

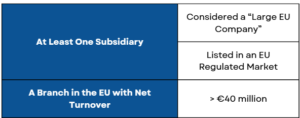

Non-EU Companies are companies outside the EU with a net turnover of €150 million in the EU for the last 2 financial years, and at least two of the following:

With the phase-in approach, there are some allowances in report submissions. We’ll discuss these in more detail in the next section, but here’s a quick summary:

- All entities:

- May omit anticipated financial effects from climate and environment-related impacts, risks and opportunities in Year 1

- Qualitative disclosures on anticipated financial effects are permitted if quantitative disclosures are impracticable in Years 1 to 3

- May omit some additional Social disclosure requirements in Year 1

- Small entities:

- May omit data on GHG emissions, biodiversity, resource use, and various social disclosure in Years 1 and 2

What Information is Required?

Reports submitted to the CSRD must include financial as well as non-financial disclosures.

Financial Disclosures

Financial disclosures aim to cover the monetary aspects of a company’s carbon footprint. This includes traditional financial statements, information on how risks and opportunities affect financial performance and positions, and the financial implications of sustainability-related issues.

For example, a company may estimate that climate-related risks could result in a potential loss due to increased energy costs and regulatory fines associated with non-compliance with emissions standards. In this section, they would highlight the expected loss, for example, €20 million in the next 5 years.

Another example could be reporting on a company’s carbon intensity (CO2 emissions per unit of revenue). For instance, a particular company may have a carbon intensity of 50 kg of CO2 per €1,000 in sales. This would be included in the financial disclosure section. Another example would be if a company set aside

Non-Financial Disclosures

Non-financial disclosures focus on a company’s approach to the areas of Environmental Social and Governance. They can be broken up into two categories: General Disclosures and Topical Disclosures. Both disclosures are governed by the European Sustainability Reporting Standards (ESRS) framework.

General Disclosure:

General Disclosures are required by all companies subject to the CSRD. They are broad and provide an overall picture of how sustainability is embedded in a company’s strategy and governance.

Some examples of General Disclosures are as follows:

Strategy and Business Model (SBM):

This details how a company incorporates sustainability factors into the business model and long-term strategy of a company.

For example if a skincare company plans to cut out plastic packaging by 2030, this section would include information on the strategy to do so and how it would affect the overall business model.

Governance:

How the management board oversees sustainability-related risks and opportunities.

This could include the appointment of a sustainability executive to oversee all sustainability related matters.

Impacts, Risks and Opportunities:

This would include a description of the principal risks and opportunities that the company faces related to sustainability, including both short-term and long-term impacts.

For example, a wind company may be subject to physical climate risks such as extreme weather events due to the location of the turbines. This can pose threats to infrastructure, resulting in higher maintenance costs or losses when the turbines are not in operation due to unexpected weather patterns.

Metrics and Targets:

Any sustainability-related goals and targets set by the company and its performance in achieving them.

For example if a company has a plan to achieve Net-Zero by 2040, this would include a high-level overview of the plan as well as milestones and progress updates.

Topical Disclosures:

Topical Disclosures are more focused on specific sustainability issues. They are broken up into 3 categories: Environmental, Social, and Governance. Each category is then broken down into sub-categories. For example, Environmental Standards are broken up into 5 subcategories (European Sustainability Reporting Standards (ESRS) E1 – E5), Social Standards are broken up into 4 subcategories (ESRS S1 – S4), and Governance is broken up into 1 subcategory (ESRS G1).

For more details on each of the subcategories, please see our corresponding blog posts on ESRS E1-E5, ESRS S1-S4, and ESRS G1.

CSRD NetSuite Best Practices

As you can see, CSRD Reporting requires a high volume of data and a detailed, tailored approach. What solution could be better than using the data already saved in your existing ERP platform? By using your data within NetSuite, CarbonSuite is able to provide a tailored, automated approach to developing CSRD-compliant reports. (For a brief video-overview of CarbonSuite’s Carbon Accounting process, see here).

Let’s have a closer look at CarbonSuite’s approach to CSRD Reporting. CarbonSuite separates the CSRD Reporting process into two distinct processes: 1) Carbon Accounting and 2) Sustainability Reporting. This is because carbon accounting follows the methodology of the GHG Protocol and is the most time-intensive process in CSRD Reporting. However, the first step is to define the scope of your reporting using a Double Materiality Assessment.

Double Materiality Assessment

Using CarbonSuite’s CSRD Disclosure tool, you can work through your Gap Analysis, Double Materiality Assessment, Value Chain Mapping, and other requirements under ESRS 1: General Requirements. This is a crucial first step because it defines which data points will be considered “material” for CSRD Reporting. This is the basis for preparing disclosures, and you can find more information on it in ESRS 2: General Disclosures.

Carbon Accounting

Set Organizational & Operational Boundaries

Define which subsidiaries, locations, and assets, and types of activities to include in your carbon reporting.

Identify Emission Sources

Determining your emission sources during the initial setup of CarbonSuite is a one-time procedure that allows a company to define any and all possible sources of GHG emissions. This includes everything from purchased electricity to water use to end-of-life treatment of products sold. In this step, we consider emissions throughout the entire value chain, allowing for easy and accurate reporting later on.

Collect Data

Once you’ve defined your emission sources, it’s time to automate your carbon accounting! Using data already stored within NetSuite, CarbonSuite parses through your activity data, matches each activity to an emission category, and calculates your GHG emissions. Yep – it’s that simple! CarbonSuite can also collect other environmental data from NetSuite transactions, such as energy consumption, water consumption, and waste generation. These are additional data points within CSRD.

Calculate Emissions

CarbonSuite automatically calculates your carbon emissions, and defines them by emission and carbon dioxide equivalent, compliant with CSRD reporting requirements.

Audit Emissions

Once emissions have been calculated, they are stored in the Emission Workbench, a feature within CarbonSuite allowing you to easily reconcile data and fix any errors. The Carbon Ledger is easily auditable and records all changes made in the process.

Generate Reports

CarbonSuite allows for easy generation of dashboards and reports, giving you real-time visibility into emissions, making data-driven communication easily attainable.

Identify Reduction Strategies

Once emissions are calculated, CarbonSuite’s Reduction Strategy feature allows companies to easily generate reduction strategies to satisfy reduction disclosure requirements of the CSRD. CarbonSuite even has partners worldwide to help you design and implement strategies to reduce your GHG emissions. See our Reduction Strategies for more information.

Sustainability Reporting

Collect Other Environmental, Social, and Governance Data

Using CarbonSuite’s CSRD Disclosure Module, you can easily integrate other software systems and consolidate data for every ESRS data point in one place. Much of the environmental data can come from CarbonSuite via your NetSuite account, but oftentimes much of the Social and Governance data exists in other systems (ex: HRIS system) or offline.

Audit CSRD Report

Once you have collected all of your data for CSRD Reporting, you can use CarbonSuite’s platform to audit your results. Because these are mandatory disclosures, this is a crucial step. Review each data point and validate each against your materiality thresholds and prepare for disclosure.

Submit Disclosure

CSRD requires companies to submit sustainability disclosures in an annual report known as the “Sustainability Statement.” This Sustainability Statement is required alongside financial reports. CSRD does however require that the report be both “human readable” and “machine readable.” Typically, companies will publish a PDF version of the Sustainability Statement and an XBRL tagged version.

The best thing you can do for your business is start preparing today. Whether reporting requirements will affect your business at the start of 2025 or 2028, making preparations and collecting useful data now will make the reporting process more cost effective and hiccup-free when the time comes. Luckily, CarbonSuite provides an opportunity maintain all of the data required for CSRD reporting within NetSuite.

If you are a NetSuite user, CarbonSuite provides the simplest and most effective way to transform your ERP data into meaningful, audit-ready reports. For more information, contact the team here.

Not in the EU but curious if sustainability reporting requirements may affect your business? Check out our Sustainability Disclosure Tracker.