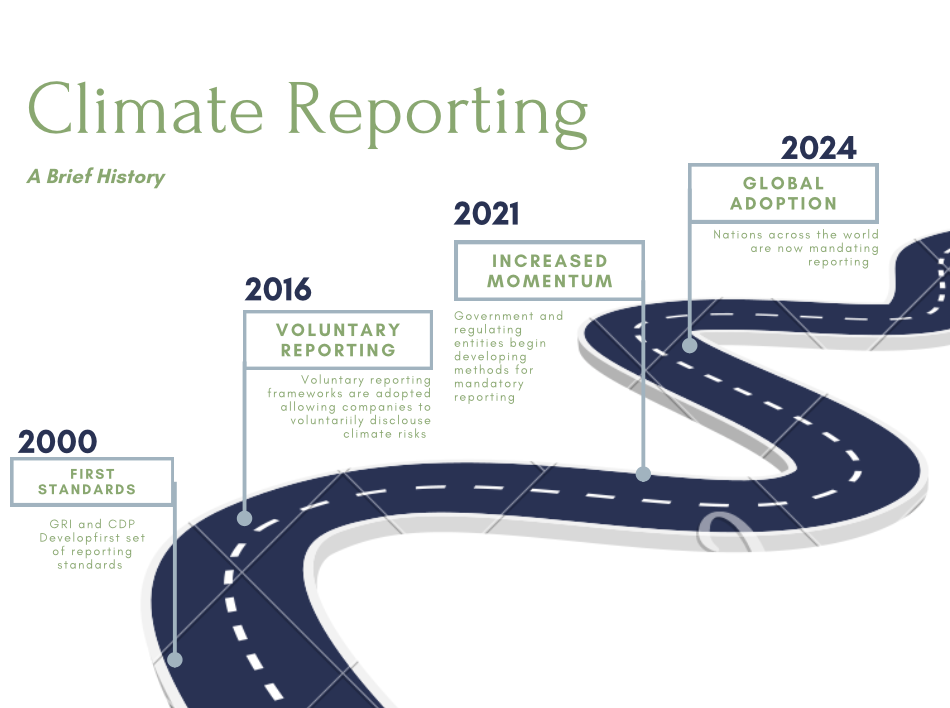

Across the world, organizations are now releasing sustainability reports. This reporting can be done voluntarily, however many government bodies and regulatory organizations are now enforcing mandatory reporting.

Sustainability Reporting has been around since 1997, beginning with the launch of the Global Reporting Initiative (GRI). The GRI is an independent organization that provides a framework for measuring and reporting greenhouse gas (GHG) emissions, energy use, and climate change strategies. The GRI is considered to have established the first global framework for sustainability reporting. Their first guidelines were released in 2000, known as the G1 Guidelines. Shortly following, the Climate Disclosure Project (CDP) launched, providing a global environmental disclosure platform for companies to measure and manage their environmental risks. Since the birth of the GRI and the CDP, sustainability reporting has expanded widely across the world, and has gained momentum in recent years.

2015: Launch of Task Force on Climate-related Financial Disclosures (TCFD) & Science Based Targets Initiative (SBTi)

- The Task Force on Climate-related Financial Disclosures (TCFD) is created by the Financial Stability Board (FSB). Their primary focus is to create a voluntary framework to disclose financial related risks of climate change to investors, leaders, insurers, and other stakeholders.

- The SBTi is created as a collaboration between the Climate Disclosure Project (CDP), the United Nations Global Compact (UNGC), the World Resources Institute (WRI), and the World Wide Fund for Nature WWF). Its aim is to mobilize companies to set emission reduction targets. It also allows them to benchmark their targets against other companies.

2016: GRI Transitions from Guidelines to Modular Standards

- The GRI transitions from guidelines to modular standards, combining best practices from previous years into easy-to-follow standards. This transition included the GRI 300 series, different from the previous G4 Guide. The GRI 300 series includes GRI Standards 301-308, which offer guidance on making environmental disclosures in line with GRI. GRI-305 is where you can find emission disclosures.

2021: EU Proposal for Corporate Sustainability Reporting Directive (CSRD), International Sustainability Standards Board (ISSB), UK Sustainability Disclosure Standards (SDS), Singapore Stock Exchange (SGX), CDP Standards Released, & Securities and Exchange Commission (SEC)

- The EU proposes the Corporate Sustainability Reporting Directive (CSRD), which aims to replace the NFRD. This change includes expanding the scope, standardizing sustainability reporting requirements, as well as mandating audits for sustainability information.

- The International Financial Reporting Standards Foundation (IFRS) announces the creation of ISSB to develop comprehensive global baseline sustainability reporting standards at COP26, the UN Climate Change Conference in Glasgow.

- The Singapore Stock Exchange (SGX) publishes a list of Core ESG metrics and begins to require reporting for all publicly traded companies on the SGX.

- The CDP releases a new strategy on climate reporting, offering a voluntary global reporting framework detailing how to complete environmental disclosures.

- The SEC begins working on enhanced climate-related disclosure requirements for publicly traded companies in the United States. This framework uses aspects of the GHG Protocol as well as the TCFD framework.

2022: GRI Standards 2021, Japan Financial Services Agency (FSA) & EU Carbon Border Adjustment Mechanism

- The GRI updates its standards to better align with international reporting requirements as well as improve the integration of sustainability into business strategies.

- The UK mandates TCFD-aligned disclosures for large companies and financial institutions, aiming to improve the transparency of climate-related financial risks.

- Japan’s Financial Services Agency (FSA) publishes its finalized “Supervisory Guidance on Climate-related Risk Management and Client Engagement”. As a result, publicly traded companies in Japan must report on climate-related risks and management.

- The EU passes the Carbon Border Adjustment Mechanism (CBAM), a mandatory disclosure framework requiring organizations to report direct as well as indirect emissions from the products they import into the EU.

2023: EU Corporate Sustainability Reporting Directive (CSRD), California SB-261, California SB-253, UK TCFD Reporting Requirements,CBAM Transitional Period Begins, IFRS S2, UK SDS, Brazil Ministry of Finance and Comissão de Valores Mobiliários, & U.S. SEC Climate Disclosure Rule

- The CSRD replaces the NFRD. The purpose of this change is to extend the scope and depth of mandatory sustainability disclosures. It includes requiring assurance of sustainability information. The publishing takes under the European Sustainability Reporting Standards (ESRS). It affects both EU companies and non-EU companies with EU subsidiary meeting certain requirements

- California Senate Bill 261, also known as Climate Related Financial Risk Act (CRFRA), is passed, requiring companies with over $500 million in revenue that do business in California to report their Scope 1, 2, and 3 greenhouse gas emissions.

- ‘Senate Bill 253, also known as the Climate Corporate Data Accountability Act (CCDAA), is passed. This is a mandatory framework affecting companies with over 1 Billion USD in revenue that do business in California. Affected businesses must report their Scope 1, 2, and 3 greenhouse gas emissions. Affected businesses must begin reporting Scope 1 and 2 emissions by 2026 and Scope 3 by 2027.

- The EU CBAM framework enters its transitional period. This requires companies to begin reporting emissions, but allows for estimations in calculating product emissions. Once fully implemented, companies will need to report actual emissions as well as purchase offsets to balance the carbon associated with imported products. The full implementation will begin in 2026.

- The ISSB issues IFRS S2 – Climate-related Disclosures, a voluntary global framework. This enables organizations of all sizes to disclose their environmental impacts as well as climate risk. The IFRS foundation also takes over the monitoring of the progress of companies’ climate-related disclosures related to the TCFD.

- The UK government lays plans to establish the UK Sustainability Reporting Standards (SRS) in its 2023 green finance strategy. This will likely be based upon the IFRS S1 and IFRS S2.

- Brazil announces the new International Sustainability Standard Board’s (ISSB). The Brazilian regulatory framework will incorporate IFRS S1 and S2 Disclosures. This affects publicly traded companies in Brazil. Mandates will begin on January 1, 2026.

- The Security Exchange Commission (SEC) proposes rules requiring publicly traded companies to include certain climate-related disclosures in their registration statements as well as periodic reports. This will include information about climate-related risks that are reasonably likely to have a material impact on their business, results of operations, or financial condition.

2024: Implementation of CSRD, Australian Climate-Related Financial Disclosure (CRFD), IFRS S1, & China Shenzhen, Shanghai, & Beijing Stock Exchanges

- CSRD implementation requires companies within the EU to align their reporting with the new CSRD requirements.

- Australia publishes an overview of the Exposure Draft Legislation Climate-Related Financial Disclosure (CRFD) and shortly after, voting begins in parliament. It proposes disclosure of GHG emissions as well as climate related risks for Australian companies.

- IFRS S1: General Requirements for Disclosure of Sustainability-related Financial information goes into effect on January 1, providing a framework as a voluntary global reporting initiative.

- China announces mandatory disclosures under a wide range of ESG Material. The Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) published mandatory requirements. Meanwhile, the Beijing Stock Exchange (BSE) is starting with voluntary reporting requirements. This affects all publicly traded companies listed on Chinese stock exchanges.

To learn about the various voluntary and mandatory reporting frameworks in more detail, see our corresponding blog post https://carbon-suite.com/climate-disclosure-tracker/.